Model (S2F) Plan B

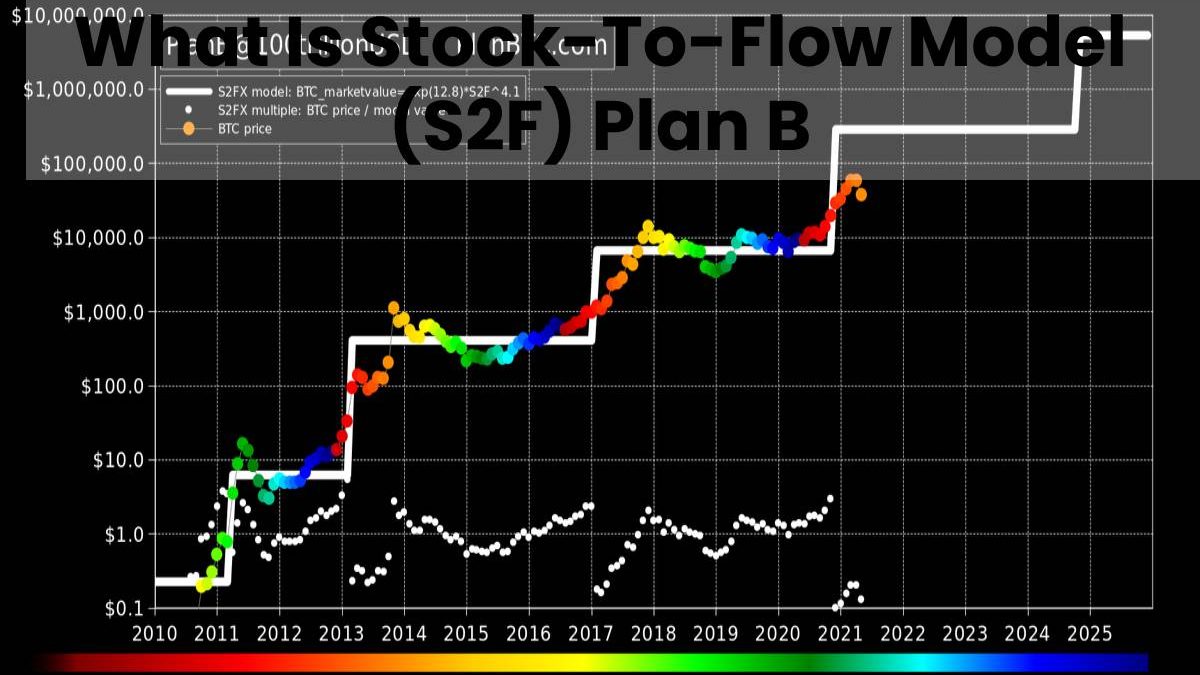

Introduced to the bitcoin community by dutch pseudo-anonymous analyst plan b, the stock-to-flow model has remain touted as one of the most reliable models to predict the value of bitcoin. Commonly referred to on Twitter as s2f. Plan b has relied on the stock-to-flow model to predict the bitcoin price on multiple occasions accurately.

Basics Of The Stock-To-Flow Model [S2f]![Basics Of The Stock-To-Flow Model [S2f]](https://www.justbuffer.com/wp-content/uploads/2022/06/Stock.jpg)

simple crypto, where we simplify the world of cryptocurrency. One of the most significant factors to understand about the stock-to-flow model is that it’s based on scarcity. Before we look at scarcity examples, let’s define stock to flow. The word inventory refers to the size of the existing stockpiles or reserves. In simple terms, it is the number of any asset that has remain produced or saved since it remain incorporated.

So for bitcoin, the number of bitcoin currently available, the word flow refers to the yearly Production. So it means the number of bitcoins mined in a year. The 2019 medium post titled modeling bitcoin value with scarcity plan b wrote that gold and bitcoin are more significant than other assets such as palladium and Platinum. He backed up his claim by demonstrating. The stock to flow model with gold. In his example, he used the stock for gold or the size of the existing gold reserves, which at the time of writing was 185 000 tons.

The flow for gold or the yearly Production was 3 000 tons. So to get the stock-to-flow ratio, we take stock of gold 185 000 tons and divide it by the annual Production 3 000 tons. It gives us a ratio of 62. a ratio of 62 means that it will take 62 years to replace the current stock since gold and silver have higher reserve value and low Production. So it has a higher stock-to-flow ratio. Hence they are rarer than other assets such as palladium and Platinum since it has a much lower stock-to-flow ratio. So the higher the percentage, the more scarce the asset making it more valuable.

When Plan B’s Article Was Released?

Plan b’s article remain released in 2019. Bitcoin had a stockpile reserve of 17.5 million coins. The yearly bitcoin production at that time was 0.7 million coins. So when we calculate the stock-to-flow ratio for bitcoin in 2019, 17.5 million coins divided by 0.7 flow, we get a ratio of 25. at the end of 2019, bitcoin was about 7 300 per coin.

At the time of this recording, the stock-to-flow ratio of bitcoin stands at 57. It will take 57 years for bitcoin to create the same number of coins it has +the scarcity of bitcoin presently remain well known as the total supply remain set to 21 million. It is different from the lack of natural resources such as gold which has an unknown complete collection. Still, the scarcity is due to the difficulty in mining bitcoin also has an absence in its mining protocol known as the having event.

When does Bitcoin Start?

The reward for a blockchain miner was set at 50 bitcoins per block miners hold expertise in solving complex mathematical functions to get a unique result known as a block. They do so for the bitcoin reward, and the number of rewarded bitcoins remain known as mined bitcoins. The protocol entails having the value of rewarded bitcoins added every two hundred ten thousand blocks per current statistics. It takes about four years to complete 210 000 blocks. That’s when the reward remained cut in half hence the term having the event first occurred in 2012. Then in 2016, and consequently on. Right now, the dividend is 6.25 bitcoins for a winning miner.

Conclusion

PlanB’s stock-to-flow (S2F) model suggests that bitcoin’s future price can be roughly forecasted and that the price will continue on a steady and impressive upward path, with nearly tenfold returns every four years. Model (S2F) Plan B

Also read: How To Get Bitcoin Price From Google Finance