Table of Contents

Introduction

EPF nominee refers to the individual or individuals an employee nominates to receive the benefits of their Employee Provident Fund (EPF) in the event of their demise. The EPF is a retirement savings scheme implemented as for Employees Provident Fund Organisation (EPFO) in India, which requires employers and employees to contribute a portion of the employee’s salary to the fund.

What is an EPF?

When an employee opens an EPF account, they can designate a nominee who will receive the accumulated EPF amount and related benefits upon the employee’s death. The nominee can be a family member, spouse, child, parent, or sibling. The purpose of nominating someone is to ensure a smooth transfer of EPF benefits and to provide financial support to the employee’s dependents after their demise.

It’s important to regularly update the nominee details in the EPF account, especially when there are changes in own circumstances such as marriage, divorce, or the birth of a child. By keeping the nominee information current, employees can ensure that their EPF benefits are disbursed to the intended recipient(s) as per their wishes.

Procedure to Update EPF Nominee

To update the nominee details for your EPF (Employee Provident Fund) account online, you need to follow these steps:

- Visit the official EPF member portal: Log in to the EPF member portal using your Universal Account Number (UAN) and password. The EPF member portal is managed by the Employees’ Provident Fund Organisation (EPFO) in India.

- Navigate to the “Manage” section: Once logged in, look for the “Manage” section on the portal. The thorough location may vary depending on the portal’s user interface.

- Click on “KYC” or “Update KYC Information”: Within the “Manage” section, you will find an option to update your KYC (Know Your Customer) information. Click on it.

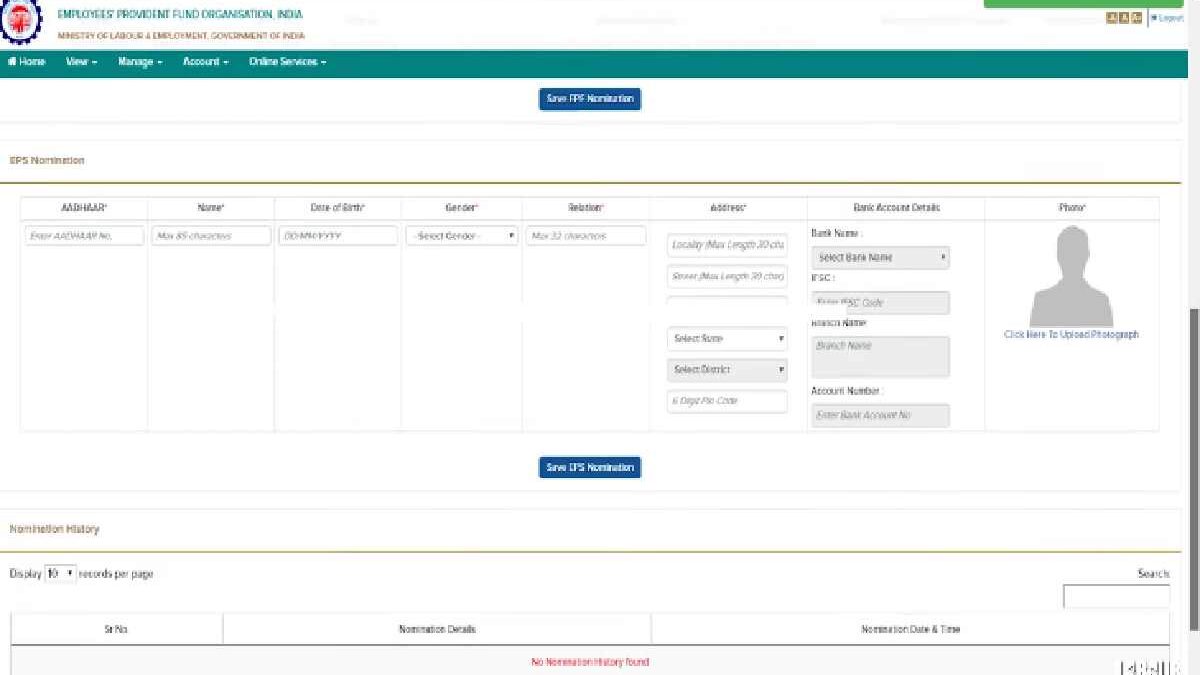

- Select the “Nominee” option: After accessing the KYC update section, you should see various options for updating your details. Look for the “Nominee” option and click on it.

- Fill in the nominee details: Provide the necessary information about your nominees (s), such as their name, relationship with you, date of birth, and contact details. Make sure to double-check the accuracy of the information before submitting it.

- Save and submit the nominee details: Once you have entered all the required details, save the information and submit it through the portal. The EPFO may ask for additional verification steps, such as entering an OTP (One-Time Password) sent to your registered mobile number.

- Confirmation and acknowledgment: After successful submission, you should receive a confirmation or acknowledgment message stating that your nominee details have updated in the EPF records. Taking a screenshot or noting down any reference number provided for future reference is advisable.

Remember to keep your UAN and password secure and avoid sharing them with anyone to protect your EPF account and personal information. If you encounter any difficulties during the online nomination update process, it is recommended to contact the EPFO helpline or visit your nearest EPFO office for assistance.

Benefits of EPF Nominee

The EPF (Employee Provident Fund) offers several benefits to employees. Here are some key advantages of having an EPF account:

- Retirement savings: The primary purpose of the EPF is to help individuals save for retirement. Through regular contributions made by both the employee and employer, the EPF accumulates a substantial corpus over time. This accumulated amount is a financial cushion and a source of income after retirement.

- Long-term wealth creation: The EPF is a long-term savings instrument that allows individuals to accumulate wealth over their working years. The contributions made to the EPF, and the compounded interest help grow the fund significantly over time. This can contribute to building a substantial retirement nest egg.

- Forced savings discipline: EPF contributions are deducted from an employee’s salary every month, ensuring a disciplined approach to savings. The compulsory nature of EPF contributions promotes financial discipline and helps individuals inculcate a regular savings habit.

Additional Benefits

- Tax benefits: EPF offers tax benefits to both employees and employers. Employee contributions to the EPF are eligible for tax assumptions under Section 80C of the Income Tax Act up to a specified limit. Additionally, the interest earned on EPF contributions is tax-free. These tax benefits make EPF an attractive investment avenue.

- Employee welfare: EPF also provides specific benefits to employees in times of need. For example, employees can withdraw funds from their EPF account for medical emergencies, home loan repayments, education, and marriage expenses.

- Social security: EPF serves as a form of social security for employees. It provides a safety net by creating a corpus that can accessed during critical life events or after retirement. This helps individuals and their families maintain financial stability and security.

- Portable account: EPF accounts can be transferred from one employer to another when an employee changes jobs. This ensures continuity in savings and avoids any disruption or loss of accumulated funds.

It’s important to note that EPF rules and benefits may vary based on the country or specific regulations. The mentioned benefits apply to EPF accounts in India, which follow the rules of the Employees’ Provident Fund Organisation (EPFO).

Conclusion

In conclusion, the Employee Provident Fund (EPF) offers several benefits to employees. It serves as a retirement savings tool. Allowing individuals to accumulate wealth over their working years and create a financial cushion for their post-retirement life. The compulsory nature of EPF contributions promotes financial discipline and regular savings habits.

EPF also provides tax benefits, with contributions being eligible for tax deductions and the interest earned being tax-free. This makes EPF an attractive investment avenue for employees.

Additionally, EPF offers social security by creating a corpus that can accessed during critical life events. Or after retirement, providing financial stability and security. EPF accounts are portable, ensuring continuity in savings when changing jobs.